Fed rate hike

The Federal Reserve will raise interest rates just one more time in November before it stops due to a soaring US dollar according to market veteran Ed Yardeni. The increase comes following the latest consumer price index report showing that inflation cooled in.

6 Strategies To Predict The Chance Of A Fed Rate Hike In 2022 Dttw

In its Wednesday statement the.

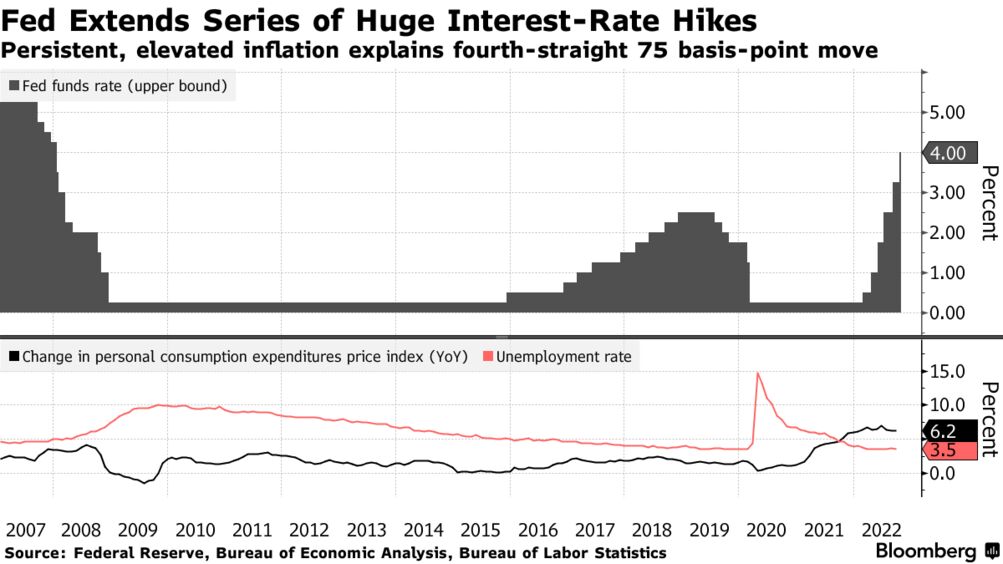

. The Federal Open Market Committee said it was increasing its key federal funds rate by 05 after announcing four-straight 075 hikes at its most recent meetings. Thats why the average 30-year fixed rate mortgage rate increased by about 450 basis points between January 2021 and October 2022 compared with just 300 basis points for the federal funds rate. Economists expect Fed Chair Jerome.

1 day agoAnd they could go up even more after yesterdays Fed rate hike. 2 days agoThe Federal Reserve is expected to raise interest rates by a half percentage point Wednesday yet signal it will continue its battle against inflation. Each time the Federal Reserve.

1 day agoThe Feds rate-setting committee hiked its benchmark rate by 05 percentage point on Wednesday lifting its target rate into a range between 425 and 45 the highest level in 15 years. During his post-meeting conference Fed Chair Jerome Powell signaled the central. The Feds rate hikes have had a clear impact on the housing market with surging mortgage rates helping to put a dent into home sales.

Adjustable-rate loans such as ARMs that are no longer in the fixed-rate period and credit cards with variable rates often see higher interest rates when the Fed hikes their benchmark rate. The combined effect of QT and fed funds rate hikes shows up in interest rates tied to both benchmarks like mortgage rates. The Federal Reserve has announced that it will raise interest rates another 05 percent to 45 percent marking the seventh increase of 2022.

Some even expect the Fed to. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. This will however be the smallest of the last four rate hikes showing promise that the increases will slow soon.

The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. That point of view runs counter to market consensus which currently expects a 75 basis point rate hike in November followed by a 50 basis point rate hike in December.

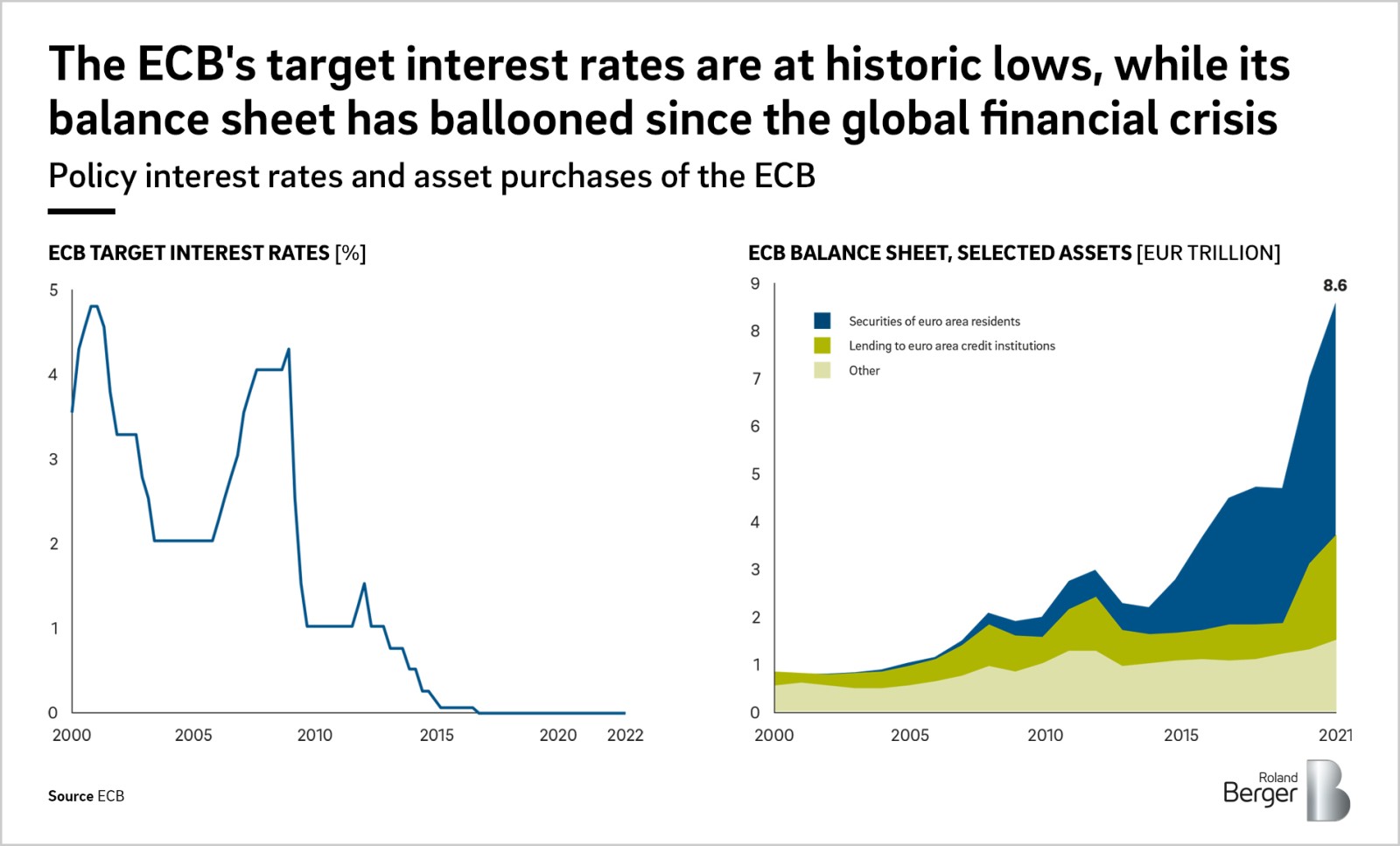

What If The Ecb Raises The Key Interest Rates Roland Berger

Federal Reserve May Go Easy After 75 Basis Point Rate Hike Next Week Business Standard News

Fed S Jerome Powell Signals Smaller Rate Hikes Ahead On Path To Higher Peak Bloomberg

Ngy0qv60bao5 M

Powell Signals Smaller Rate Hikes Ahead On Path To Higher Peak Bnn Bloomberg

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Largest Interest Rate Hike In 22 Years How Will The Market React Propertylimbrothers

Hpyz9bl6lh6s7m

How Fed S New Interest Rate Hike Affects Inflation And You Money

Powell S Fed Rate Hike Plans Get Jolted By Inflation Eco Week Bnn Bloomberg

Us Federal Reserve With The Third Interest Rate Hike This Year

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

The Fed Is Raising Rates Here S How Markets Have Performed In The Past Northwestern Mutual

Bank Of England Announces Biggest Interest Rate Hike In 27 Years

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

Bank Indonesia Goes For 0 50 Interest Rate Hike At September 2022 Policy Meeting Indonesia Investments

Fed Hikes Rates By 0 75 Percentage Point Biggest Increase Since 1994